Frequently Asked Questions

What is a Credit Report?

When you apply for credit facilities, banks and financial institutions often verify your status with credit reporting agencies like CTOS to provide them with your credit history to help them evaluate your application. Likewise, individuals and businesses can turn to CTOS to check and monitor their own credit profiles and that of others before committing to important financial decisions.

What information is in a MyCTOS Report?

A CTOS Self-Check Report is comprehensive, detailing identity verification, business exposure, directorships and business ownerships. It also contains details of legal actions, case statuses as well as bankruptcy information. Finally, the report also includes subject’s comments (if applicable).

Where does CTOS get the information from?

CTOS collects information from various public sources that include:- National Registration Department (NRD)

- Registrar of Societies

- Publications of legal proceedings and notices in newspapers and government gazettes

- Companies Commission of Malaysia (CCM)

- Malaysia Insolvency Department

- Subsribers’ contributions of litigation records

How can I get a MyCTOS Report?

You would first need to register in order for you to obtain your CTOS User ID. Once your CTOS User ID is activated, you can access your report at anytime over the Internet or via the CTOS smartphone app.

You can get more details and register by visiting our MyCTOS page – click here.

Does CTOS decide whether to approve my loans and credit applications?

No. CTOS only provides credit information to our subscribers. Any decision regarding the approval or rejection is done by the lenders themselves.

My loan has just been rejected and I was told it is a CTOS issue. Why?

There might be something in your Credit Report that needs your attention. You would need to obtain a CTOS Self-Check Report to ensure your information is accurate and up to date.

What if the information in MyCTOS Report is wrong? What can I do?

It is your right and responsibility to update the information in your CTOS Self-Check Report. All you need to do is contact our customer service representative at sarus@ctos.com.my and explain your concern. The officer may require you to provide documentary proof of settlements or conclusions i.e. letter of discharge, settlement, court order striking off the case etc. Upon receipt of these documents and insert the relevant remarks. This service of updating your record is free of charge. You will also receive a free report following this update.

I've been informed that I am blacklisted by CTOS. Why?

Contrary to popular belief, CTOS does not blacklist people or companies. CTOS only provides credit information to its subscribers. In fact, CTOS does not provide opinions or recommendations.

What if I'm still being rejected even after updating my record?

Every financial institution has its own internal credit approval policied. You might not have met some of their requirements. Loans are approved based on multiple factors such as:- Purpose of loan

- Source of repayment – including disposable income and ability to repay the loan

- Your borrowings and credit history

- Collateral offered

- The lenders’ policies & willingness to take risk

I was rejected by one financial institution. Will the others do the same?

Banks and financial institutions have their own set of lending policied and take on different levels of credit risk. An application rejected by one may be acceptable to another. However, undischarged bankrupts and wound-up companies will unlikely get loans approved regardless of which financial institutions they approach.

Can I prevent Credit Reporting Agencies from keeping information about me?

No, you may not. Credit Reporting Agencies are legally empowered by the Credit Reporting Agencies (CRA) Act 2010 to collect and obtain information about you.

Can I delete my CTOS record?

Records can be removed in cases of fraud and mistakes with valid proof from you. Under the requirements of the Credit Reporting Act, cases which have been settled for more than 2 years will no longer be reported.

What if the cases against me are in progress or have not been resolved?

In cases like this, you have an opportunity to provide comments in order to share your side of the story.

CTOS has a feature called, “Subject’s Comments” which allows you to provide explanations regarding any records in your CTOS report.

You can download the “Subject’s Comment” form – click here.

How long will the record stay in my credit report if I have settled my debt?

Your record will stay for another 24 months from date of settlement, as this is permissible under the CRA Act 2010. After that, it will not be disclosed in your credit report.

Do you need my consent before you disclose my report?

Yes. The CRA Act 2010 stipulates that your consent is required before any CRA can release your report to third parties. The consent will be given to a CRA via the consent form/application form by the credit grantor.

Do I need to pay for a MyCTOS Report?

Upon activation of your CTOS User ID, one FREE copy of the report will be sent to you. All verified users will also receive a FREE MyCTOS Report in January and July. There’s also a free notification service that alerts you of any changes in the litigation record(s) on your report.

Additional Forms

What is CTOS SecureID and what can it do for me?

CTOS SecureID is a fraud protection and credit monitoring service with dark web monitoring. Subscribers get fraud detection alerts when there are changes to their credit profiles, and can monitor their credit health with quarterly MyCTOS Score reports. In addition, subscribers also get Takaful coverage up to RM20,000.

What is identity theft?

Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses another person’s information in a way that involves fraud or deception, usually to the victim’s disadvantage. Personal data that is highly susceptible to being stolen include credit and debit card numbers, as well as information regarding bank accounts, insurance policies and medical records.

What happens if my personal information gets stolen?

Thieves often use stolen credit or debit card information to make purchases, especially online. They can call a bank and pretend to be the owner of a credit card – then cancel the credit card of a victim citing various reasons, request a new card to be routed to an address where the thief can receive it, and subsequently go on shopping sprees.

In more serious cases, identity theft may be used to facilitate or fund other crimes including terrorism, illegal immigration and phishing. With sufficient stolen information, thieves can steal tax returns, pretend to be someone else if arrested, or exhaust the victim’s medical insurance coverage (medical identity theft).

What are the signs that my identity may have been stolen?

Some warning signs that you may be a victim of identity theft:- You’ve been expecting a new credit or debit card to arrive in the mail but it’s way overdue

- You notice purchases you didn’t make when you check your credit card statements

- Important letters, packages or mail you’ve been expecting has consistently gone missing

- You’ve received a litigation notice or court document for something you’ve not done

How do I subscribe to CTOS SecureID?

To subscribe to CTOS SecureID, you’ll first need a CTOS ID account. To sign up, go to www.ctoscredit.com.my or download the CTOS mobile app. Click the ‘Sign Up’ button and fill up the form step by step. Make sure you have your MyKad (NRIC) document for identity verification purposes.

Once you have your CTOS ID account, you can subscribe to the CTOS SecureID fraud protection and credit monitoring service. Simply select the package you want, at either RM9.90 per month or RM99 per year.

If I subscribe to CTOS SecureID will my information be sold or shared with third parties?

We do not share or sell your information to third parties. For more information, please read our privacy policy.

I’ve subscribed to CTOS SecureID. Can I still become a victim of identity theft?

CTOS SecureID is a powerful scanning and monitoring system that can help protect you against identity theft to a significant level. However, there are many ways your personal identifiable information can be stolen that is not covered by CTOS SecureID’s features. So yes, the possibility of identity theft always exists, but you can take steps to lower your risk exposure.

I want to cancel my CTOS SecureID subscription. Is there any penalty?

No penalty on the cancellation will be imposed.

Who can I contact if I have further queries about my subscription?

What is the dark web?

The dark web is a part of the internet that isn’t indexed by search engines. This means that the dark web is largely ‘hidden’ as it cannot be accessed in a straightforward manner by regular internet users. A large part of the dark web is used for illegal or criminal activities – for instance, one can buy stolen credit card numbers, all manner of drugs, guns, counterfeit money, stolen subscription credentials, hacked video streaming accounts and software that can help them break into other people’s computers.

Is the dark web a bad thing?

The dark web is not necessarily a bad thing. However, due to the nature of content available on the dark web, you can be at risk if your personal identifiable information is stolen and ends up there. For instance, the dark web contains a lot of information that is highly illegal, including stolen information for sale, banned content and more. If your information appears on the dark web, it could be detrimental to you in many ways as you wouldn’t know who ends up getting hold of your data and what they’re going to use it for.

How can CTOS SecureID protect me from the dark web?

CTOS SecureID’s data breach and dark web monitoring feature scans the dark web for information that you have provided consensually. If your information turns up on the dark web, the system will pick that up and send you an alert or notification. Then, you’ll be able to take action to protect yourself, such as changing your passwords or shutting down certain accounts.

What’s the information required to set up my dark web monitoring?

When you subscribe to CTOS SecureID, you’ll be asked if you want to provide voluntary or optional information so the system can monitor and send you alerts if anything is amiss. Therefore, the more information you provide, the more ways we can help protect you – you’ll be able to enjoy the maximum protection benefit that CTOS SecureID can provide by utilising all its features to your advantage.Voluntary information you can provide for dark web monitoring:

- First 6 and last 4 digits of the user’s credit / debit card(s)

- Email addresses

- Phone numbers

- Bank account numbers

- Passport numbers

How does CTOS SecureID find my information on the dark web?

CTOS SecureID’s data breach and dark web monitoring feature scans the dark web for information you have provided consensually. If your information turns up on the dark web, the system will pick that up and send you an alert or notification.

Where can I find more information on the insurance coverage?

What is CTOS Score?

The CTOS Score is a credit score for individuals that provides an evaluation of a consumer’s credit risk. The score is presented in the form of a 3-digit number ranging from 300 to 850. The higher the score, the lower the credit risk.

What are the benefits of having your CTOS Score?

Increase your chances of getting a loan

A good CTOS Score can work in your favour by increasing your chances of getting approved for loans and new credit. A good credit score increases your creditworthiness in the eyes of banks and lenders. Knowing your score will tell you where you stand when it comes to credit health; you can then take measures to improve your score, especially if it falls in the lower range.

Speedier loan approval

Scores can be delivered instantaneously, helping lenders speed up loan approvals. Many credit decisions can be made within minutes. Even a mortgage application can be approved in hours instead of weeks for borrowers who score above a lender’s “score cutoff”. Scoring also allows retail stores, Internet sites and other lenders to make “instant” credit decisions.

Facilitate personal financial planning

If you are having trouble with debt or managing your finances in general, knowing your score can really help. With the CTOS Score, you will know what your credit health is like, and can then make decisions accordingly to manage your debt and plan your finances better. Once you go through the detailed information in your score report, you will have a better idea on where to start and what is bringing your score down the most.

Monitor the status of your credit health

If you are planning to apply for a loan or any other types of new credit, you should know what credit information banks and lenders can see about you. Your CTOS Score is a good indicator of whether you will be eligible to receive new credit, and if you are, how fast you will be likely to receive it and at what interest rates.

More credit is available

The use of a credit score gives lenders the confidence to offer you more credit, especially if your credit health is good and your score is in the higher range, as they now have more precise information on which to base their credit decisions on. When banks and lenders notice that you have a good score, they will be more inclined to offer you more credit and in some cases, perks and benefits like lower interest rates on repayments.

Get fairer credit decisions

When you apply for new credit, you would want assurance that your application will be evaluated fairly. The CTOS Score will enable lenders to focus only on the facts related to credit risk, rather than their personal feelings. Factors like your gender, race, religion, nationality and marital status are not considered in credit scoring.

What does your score mean?

Grade / What It Means to Lenders

Excellent! You’re viewed very favourably by lenders.

Very Good! You’re viewed as a prime customer.

Good! You’re above average and viable for new credit.

Fair. You’re below average and less viable for credit.

Low. You may face difficulties when applying for credit.

Poor. Your credit applications will likely be affected.

Your score couldn’t be generated due to insufficient information.

How is CTOS Score calculated?

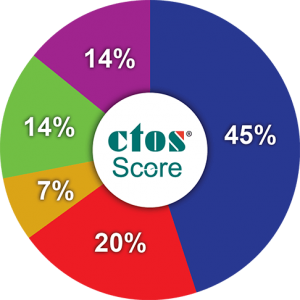

The CTOS Score is calculated based on credit information from both CCRIS and CTOS’s database. 5 factors make up the CTOS Score:

Payment History (45%)

Payment History (45%)

Whether you pay your loans on time or have missed payments in the past Amounts Owed (20%)

Amounts Owed (20%)

The number of credit facilities and the amount owed to the banks Credit History Length (7%)

Credit History Length (7%)

How long have you held a credit facility (credit card, or a loan) Credit Mix (14%)

Credit Mix (14%)

Types of loan and credit cards you hold – secured (home, car loans) vs unsecured credit (credit cards, personal loans) New Credit (14%)

New Credit (14%)

Have you been approved for new credit facilities recentlySources: Banking Payment History [derived from CCRIS, Bank Negara Malaysia], CTOS Database [Legal records & Trade References].

How can I improve my CTOS Score?

There’s no quick or instant method to fix a credit score. It takes some time for any new effort you’ve made to improve your score. The best advice for rebuilding credit health is to manage it responsibly over time, and to be consistent.

Here are some tips to help improve your CTOS Score:

Payment History

- Pay your bills on time

- If you have missed payments, get current and stay current

- Be aware that paying off a collection account won’t remove it from your credit report

- Contact creditors or legitimate counsellors if you have trouble making ends meet

Amounts Owed

- Keep balances low

- Pay off debt

- Do not close unused credit cards as a short term strategy to raise your scores

Credit History Length

- Start building a credit track record early

Credit Mix

- Apply for and open new credit accounts only as needed

- Have credit cards, but manage them responsibly

New Credit

- Do your rate shopping for a given loan within a focused period of time

- Re-establish your credit history if you had problems.

- Do not open a number of new credit cards that you don’t need

Does the free report given by CTOS every year include CTOS Score?

No. The free report only shows basic credit information. We encourage you to buy MyCTOS Score Report as it will contains your detailed credit information, which includes Banking Payment History CCRIS and CTOS Score.

Why is there no score in my report?

For a CTOS Score to be calculated, your credit report must contain enough recent credit information.

The minimum criteria are as below:- Credit account updated in the last 24 months

- Default record updated in the last 24 months

- Adverse record updated in the last 24 months

*The minimum scoring criteria may be satisfied by a single account or by multiple accounts on a credit file

Will CTOS Score change over time?

As the information in your credit report changes, so will any new credit score based on your credit report.

Will it affect CTOS Score if my name is listed in a Trade Reference* record?

*A trade reference is the payment experience information provided by a supplier, vendor, or business partner on its customer.

Yes, it will affect your CTOS Score. Make sure to contact the trade referee for settlement in order to help improve your score.

Is it important to build a credit history?

Yes. Without a credit history, you may have a much harder time qualifying for certain credit products such as credit cards and loans. It’s essential to have a credit history, especially a one that reflects good credit behaviour, debt management and financial planning.If you’re a student or fresh graduate, you should start thinking about ways to begin building a healthy credit history – this will come in handy in future, especially when you need new credit or a loan for major financial investments such as purchasing property. Building a credit history takes some time, so it’s advisable to start as soon as possible.

Why is my CTOS Score low? I have been paying my bills on time and have no credit issues.

The CTOS Score is generally calculated based on information in CTOS’s database and CCRIS data. The score is mainly made up of five factors, which is your payment history, amounts owed, length of credit history, credit mix and new credit.However, there are various other factors beyond those mentioned above that could affect your credit score, either positively or negatively.

Is my CTOS Score influenced by my income level?

No, it is not. Your income level is not one of the factors used to calculate the score.

Why is my CTOS Score different from other credit scores?

We capture unique information that is not readily accessible by the other credit bureaus, or the same data element may be stored or displayed differently by other credit bureaus. For example, we have the largest database of litigation records and trade references. Also, your CTOS Score is the only one in Malaysia based on the FICO® standard, which is the global benchmark for credit scoring.

What is eTR?

The abbreviation eTR stands for ‘Electronic Trade Reference’. A trade reference is the payment experience information given to CTOS by a supplier, vendor or business partner.A trade reference specifies information such as:

- To whom a payment has been defaulted

- The duration of the overdue payment

- The aging amount

- Details of the person in charge

- Contact information of the trade referee

How do I access trade reference information?

If you would like to know more information about a specific trade reference listing, we advise you to obtain your latest MyCTOS Score report.

You can get your MyCTOS Score report by registering for your CTOS User ID (CID) per instructions below. With CID, you can access your CTOS report instantly, be notified whenever CTOS processes any new information about you as well as enable us to contact you easily for matters related to your MyCTOS Score report or your CID.

Here are 3 ways to register for CID:

- Smart Phone Registration (iPhone or Android): Log on to the Apple App Store or Google Play, then download the CTOS App and follow the instructions.

- Biometric Registration: Walk-in to any CTOS branch and let our officers assist you.

- Online Registration: Log on to https://ctosid.ctos.com.my with your IC number and follow the instructions. Send us a copy of your MyKad (both sides) for identity verification purposes.

I have been listed under eTR. What do I do next?

Please contact the trade referee directly to resolve the matter. The contact details are available within the last section of the report under “Referee Contact”.

If you have never dealt with the trade referee before or you suspect that this could be a case of identity fraud, please contact the trade referee to seek advice on the next course of action. Alternatively, contact us immediately for assistance.

Is this legal?

CTOS is a government-registered Credit Reporting Agency (CRA) which is regulated under the Credit Reporting Agencies Act 2010. We are guided by the Trade Reference Guideline issued by the Registrar Office which came into force on 1st Jan 2018.

How does CTOS ensure that eTR information is accurate?

Subscribers who participate in sharing payment experience information (eTR) with CTOS are obligated to abide by the terms and conditions which they have agreed upon when they subscribed to CTOS’s service (Credit Manager).

As per the agreed terms and conditions, subscribers must ensure that any trade reference information which is cited is accompanied by legitimate supporting documents (e.g. legal agreements, application forms, invoices, statements of accounts, identification documents such as MyKad or passport, delivery orders, purchase orders). Audits will also be conducted periodically by CTOS, and any subscriber found to have violated the agreement will either have their account terminated or be subject to legal action.

How long is eTR information retained?

eTR information will be retained so long as borrower did not settle their outstanding debt or trade referee did not delist the trade reference. Trade referees are required to delist trade reference information within 3 working days upon settlement of the issue.

What should I do if I’ve settled the outstanding amount but my name still appears in the report?

The trade referee in question may have their own internal process (specific turnaround time) to delist trade references which have been settled. However, you may contact us directly to expedite the process.

If the trade referee is not cooperative or is unhelpful, you may contact us for further assistance.

How will being listed under eTR affect me?

Lenders and credit grantors have different lending policies and risk appetites. They make lending and credit-related decisions based on various criteria. Loans are approved based on many factors such as purpose of the loan applied for, collateral information, total borrowing amount, past credit history and more.

Trade reference information is about your past payment behaviour. As such, lenders and credit grantors may take this information into consideration during the credit assessment process, and this could affect your chances of getting your loan approved.

Still not finding what you need?

Submit your question to us.