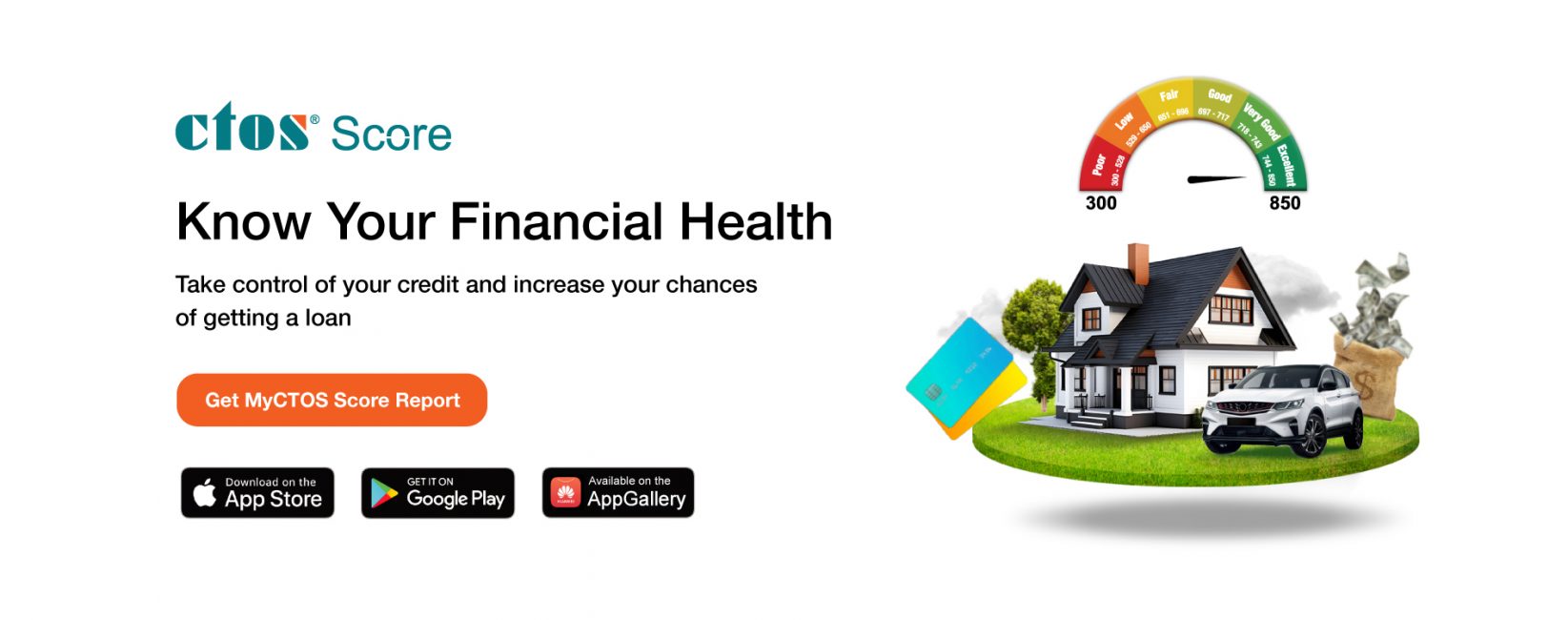

Know Your Financial Health

Take control of your credit and increase your chances of getting a loan

Malaysia’s leading Credit Reporting Agency

Empowering Malaysians to achieve better financial credit health

Regulated by the Registrar of Credit Reporting Agencies

Start your journey, sign up NOW!

MyCTOS Score Report

Credit Report & Score

RM27.00*/report

Everything in MyCTOS Basic Report

- CTOS Score

- CCRIS Records (BNM)

- Access to Rewards

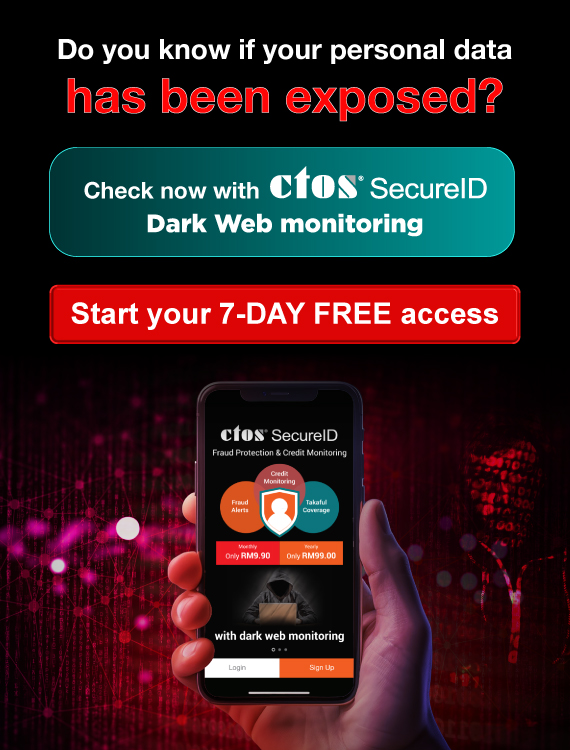

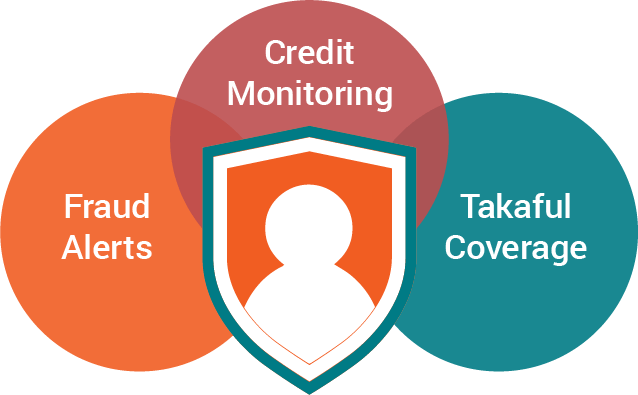

CTOS SecureID

Fraud Protection & Credit Monitoring

Monthly

RM10.10*

Yearly

RM101.00*

Fraud Protection & Alerts

- Leaked personal info & data breach on the dark web

- New credit application & account closures

- Change of address & contact information

Credit Monitoring & Reports

- 4 MyCTOS Score reports yearly

- Missed payment alerts

Fraud & Takaful Coverage

MyCTOS Basic Report

Basic Credit Report

(Without CCRIS & Score)

FREE

- Personal Information (NRD)

- Directorship & Business Interest (SSM)

- Litigation & Bankruptcy

- Trade Referee Listings (eTR)

- 2 Free MyCTOS Basic Reports a year

Safeguards you from fraud and scams, also helps you stay on top of your credit health

Malaysia’s No.1 credit management solution which helps manage and reduce business credit risk in 3 simple steps: