Deciding to buy a home is a big personal step in many ways. It could be your key to independence or simply a more comfortable place to raise your growing family. Buying a property is a significant investment and one you shouldn’t take lightly. If you’re unsure whether you can afford a home at the moment or not, it’s completely fine to rent while you work on a savings plan towards buying your dream home.

Considering if you can afford to buy

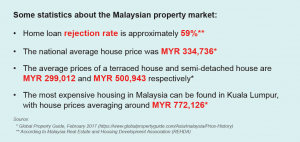

The first step towards buying your own home is deciding if you can afford it. How do you determine if you’re financially ready to buy a house? A good first step would be to do a self-check by obtaining your full credit report with credit score, such as the MyCTOS Score report. Generally, your debt should not be more than 60% of your total net income when applying for a loan or credit facility.

A MyCTOS Score report will provide you with a full, comprehensive information about all major aspects of your credit health and current credit obligations, as well as your credit score. This way, you’ll know where you stand when it comes to credit health, and will be able to make more informed decisions.