“The hardest thing in the world to understand is the income tax.” – Albert Einstein (1879 – 1955)

![]()

by my.wobb.co

I’ll come right out and say it: I’m a complete noob when it comes to doing anything hands-on. When it’s time to wax poetic and discuss at length about abstract concepts, I’m your man. When it comes to doing anything even remotely practical, I’m about as useful as a comb for bald people.

So when the powers that be (read: editors) decided to throw this worthless one here the responsibility of writing a guide to e-Filing, I didn’t (and still don’t) know if it was a practical joke or a stroke of genius. Because if a complete noob like me can figure my way through this mystical ritual of the modern age, you can too.

To embark on the sacred journey of e-Filing, you’ll need a couple of essential things:

- Your EA Form obtainable from your employer

- A LHDN e-Filing PIN

- A working computer with an internet connection

- A working brain

Let’s get right into it.

STEP 1: Obtain a PIN

Back in the good old days, you could get through this step by providing a scanned image of your IC, via online request, or even a fax… but not anymore.

NOTE: One of our readers dropped us a note stating that the LHDN e-filing PIN can no longer be requested online, by mail, or by fax any longer (as of this year). So new sign ups would have to physically make a run to the nearest LHDN branch in order to obtain the PIN. So you will need to obtain it physically at the branch. Do bring your:

– MyKad Identification / passport

– Latest salary slip / EA Form (just in case)

At the LHDN branch, take a number, and wait for your turn in order to get your e-Filing PIN. But let me help you save a full hour of waiting: You can just walk right up to the front counter (without taking a number) and tell them you’re there to get your LHDN e-Filing PIN.

You will be asked to present your MyKad IC and fill up a form with all the usual details. Once you sign the form and hand it in, you should receive a piece of paper with your LHDN e-Filing PIN (16 numbers in 4 sets of 4) printed on it.

STEP 2: Log In

Once you bring up ez.hasil.gov.my there should be a friendly link prompting you to click it if it’s your first time logging in (this is where that LHDN e-Filing PIN comes into play). Following this, you will be directed to fill up an electronic form which will allow you to also determine your preferred password for future logins.

STEP 3: e-Filing

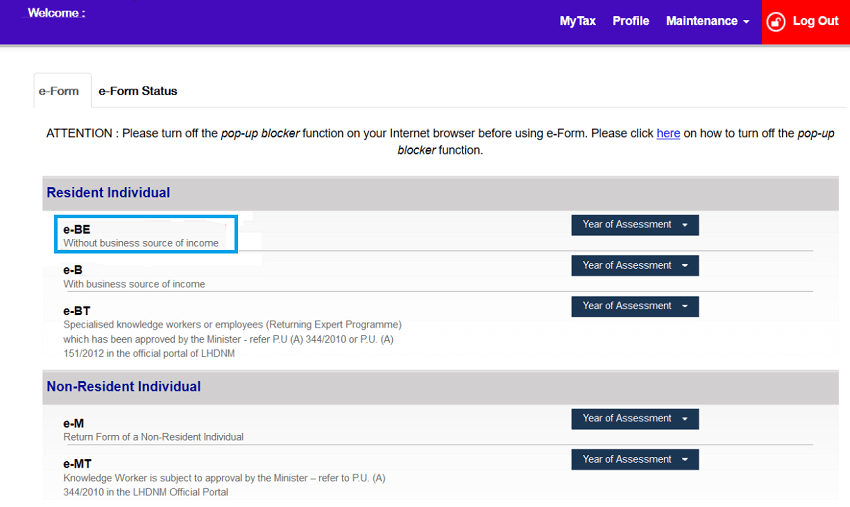

Before you proceed any further, you will have to disable any pop-up blockers or adblocks you may have installed on your system. Your browser may also have its own built-in pop-up blocker, which you will have to disable as well. In fact, for your future ease of mind, just add the whole Hasil page to the whitelist (where your browser deems the content of a site all safe for viewing). Because otherwise, the site simply refuses to work like it’s supposed to.

Look for the header that says “e-Filing” (NOT the one that says “e-Filing CKHT/WHT”), click on “e-Form”, which will bring you to a page where you will have to choose the category to which you belong.

For most of us, that would be the first one: “resident individuals without business source of income” or e-BE (because most of us are just mere employees).

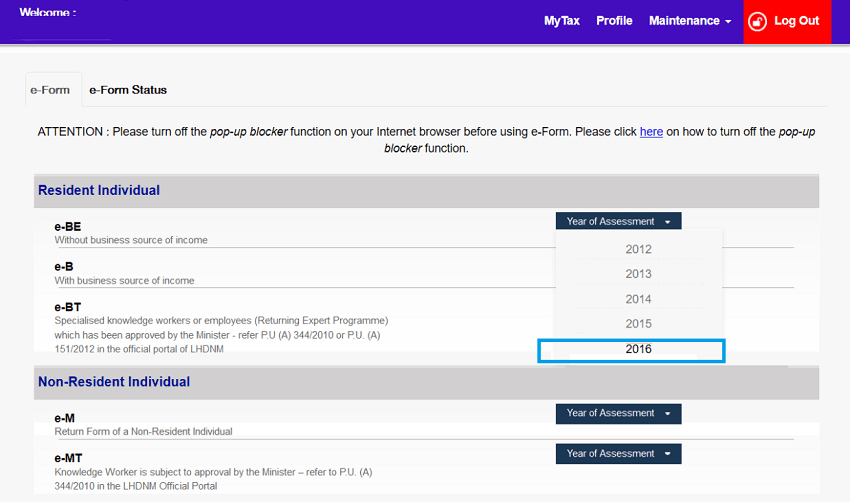

In the drop-down menu, select the year for which you’re filing your taxes (obviously it will be for the year before).

This will bring you to an official-looking page with lots of blanks to fill in. DON’T PANIC! If you’ve registered properly, the first portion, titled “Individual Particulars”, should be all filled up automatically (because it follows what you have put in your account details).

Remember to input the correct bank and bank account number for them to remit any excess money (if there is any) to. You want cash back don’t you?

Head on down to the second portion.

Around tax season, your employer should have provided you with an EA Form with an amount listed which you’ll have to key into the field titled “statutory income from employment”. This is where you key in the total amount of what you earn from your employer. You should get this figure from the EA Form that your employer prepared for you.

There are also a few other fields which detail out whether you get income from other sources like:

– Dividends

– Rents

– Interests, discounts, royalties, premiums, pensions, annuities, periodical payments

and other gains or profits

If you don’t receive any income from these sources, just like that, you may move on to the next section.

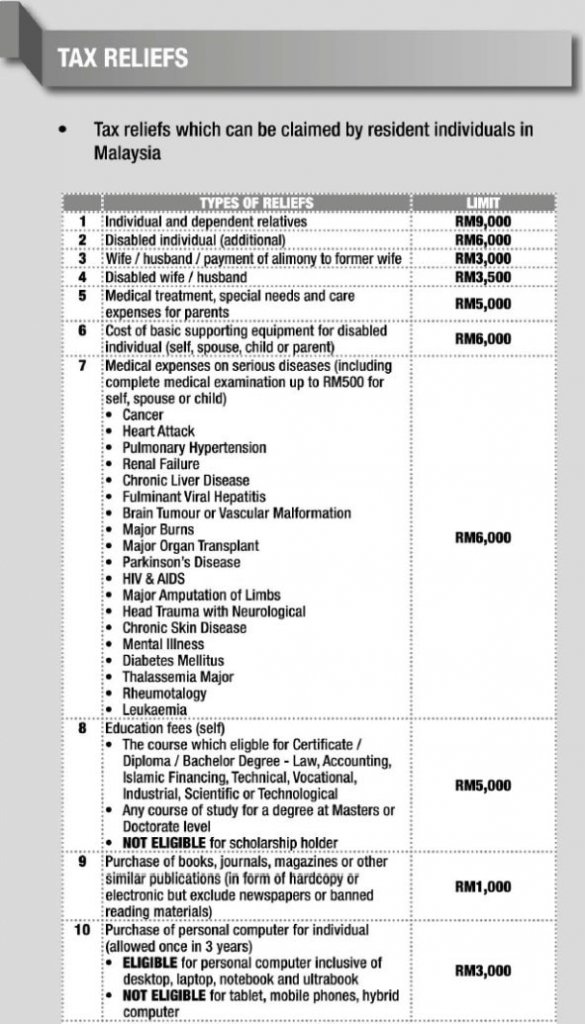

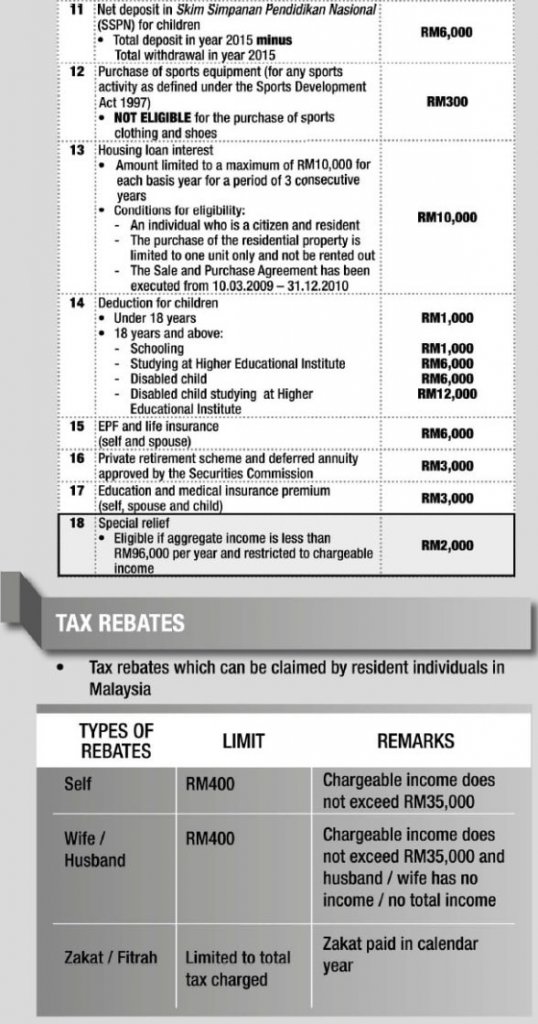

The third section is where you’ll be able to cut back on your tax payable, if there is any for that matter. Notably, you can get tax rebates if you’ve bought books (up to RM1,000) or sports equipment (up to RM300), or even your total amount spent on medical insurance (up to RM3,000) in the previous year, or if you have children (whether or not you’re married).

For your ease of reference, here is a list of what tax reliefs you would be entitled to:

Also, do remember to keep all the necessary receipts for all the items that you claimed for your tax relief (receipts of purchase of computer, books, sporting equipment, insurance payments, etc).

Once you’re ready, head on down to the final portion, titled “Summary”.

Here you can find a lot of maths that, if explained one by one, would make this already-dry article even drier; but the field that will concern you the most is 2 fields right at the very bottom, indicated by the words “Total Tax Charged” and also “Tax Paid In Excess” at the end.

The system will auto-calculate to how much you owe the government for income tax, or whether you have overpaid your taxes and the government owes you money this time.

Finally, if you’re confident you’ve filled everything in correctly, continue on to the part where you’ll have to declare that the information you’ve provided are accurate. Also listed on this page are the ways you can pay your income taxes to the government. Once you hit “submit”, you have until 30th April (unless the Government gives an extension of deadline) to pay your taxes.

Remember to save the finished form as a PDF for your own safekeeping and records just in case there is a dispute. Good to keep yourself covered!

“In this world nothing can be said to be certain, except death and taxes.” – Benjamin Franklin (1705 – 1790)