What actually is a good credit score?

The general guideline is that a ‘good’ CTOS Score will fall in the range of 697 to 850. This, however, is not a hard and fast rule and does not necessarily mean a lower score is a ‘bad’ score. When banks and lenders evaluate your application for loans or new credit, they may take other factors into consideration besides your credit score.

However, having a credit score of 697 and above can be extremely beneficial for you, as most banks and credit providers would view you as a prime customer. A good credit score can increase your chances of getting a loan, get you better interest rates and speedier loan approval, among other things.

What does your score mean?

| Score | What It Means to Lenders |

| |

Excellent! You’re viewed very favourably by lenders. |

| |

Very Good! You’re viewed as a prime customer. |

| |

Good! You’re above average and viable for new credit. |

| |

Fair. You’re below average and less viable for credit. |

| |

Low. You may face difficulties when applying for credit. |

| |

Poor. Your credit applications will likely be affected. |

| |

Your score couldn’t be generated due to insufficient information. |

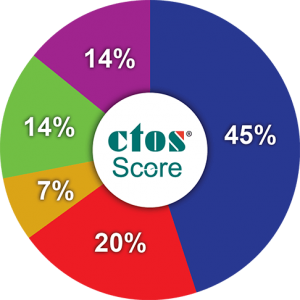

How is the CTOS Score calculated?

The CTOS Score is calculated based on credit information from both CCRIS and CTOS’s database. 5 factors make up the CTOS Score:

|

Whether you pay your loans on time or have missed payments in the past |

The number of credit facilities and the amount owed to the banks |

|

How long have you held a credit facility (credit card, or a loan) |

|

Types of loan and credit cards you hold – secured (home, car loans) vs unsecured credit (credit cards, personal loans) |

|

Have you been approved for new credit facilities recently |

|

Sources: Banking Payment History [derived from CCRIS, Bank Negara Malaysia], CTOS Database [Legal records & Trade References]. |